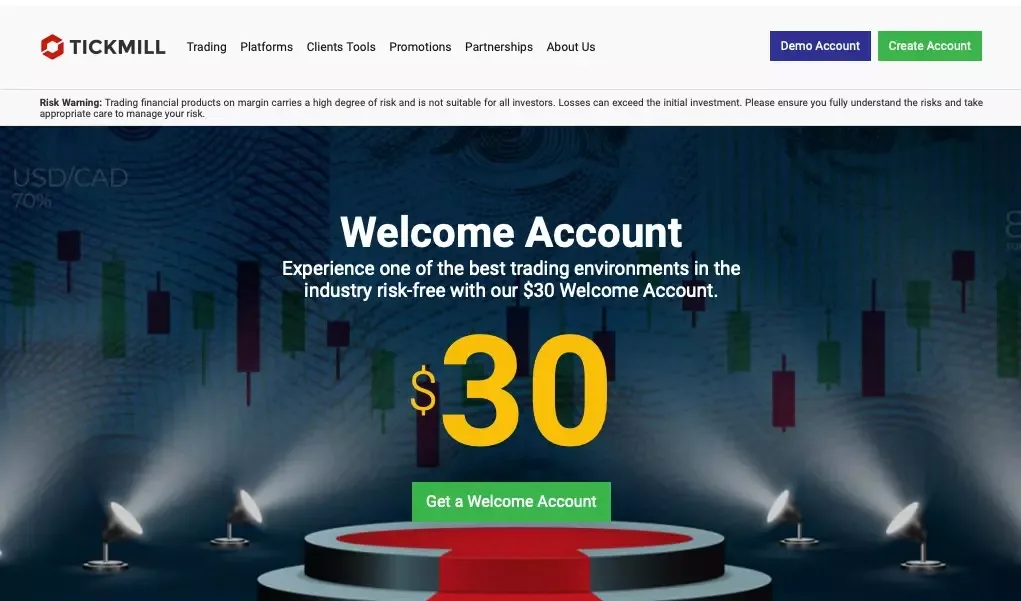

Welcome Account Program Overview

Tickmill offers South African traders a $30 Welcome Account bonus program providing market access without initial deposits. The program operates through verified trading accounts with 60-day duration periods. Traders access full platform functionality through MT4 and MT5 terminals. Real market conditions apply with standard execution parameters. Trading profits remain available for withdrawal under specific terms. Account registration requires standard verification procedures.

Welcome Bonus Specifications:

| Feature | Value | Duration |

| Bonus Amount | $30 | 60 days |

| Trading Access | Full | Program period |

| Minimum Trade | 0.01 lots | Per position |

| Maximum Leverage | 1:30 | Retail clients |

Account Activation Process

South African traders initiate Welcome Account activation through structured procedures. Registration requires valid identification documentation and residence proof. Email verification confirms communication channels. Phone validation ensures contact accuracy. Support assists with documentation submissions. Processing typically completes within one business day. Geographic restrictions apply within specific regions.

Verification Requirements

Required documents include:

- Valid government ID

- Recent utility bill

- Proof of residence

- Active email address

- Valid phone number

Trading Platform Integration

Welcome Account holders access markets through standard MT4 and MT5 platforms. Platform downloads remain available for desktop and mobile devices. Server connections utilize dedicated South African nodes. Technical analysis tools provide full functionality. Custom indicators require verification before installation. Expert Advisor usage maintains specific limitations. Chart templates save across sessions.

Platform Features

Trading capabilities include:

- Real-time quotes

- Multiple chart types

- Technical indicators

- Trading signals

- Market analysis tools

Trading Conditions Application

Welcome bonus accounts operate under standard market conditions matching live accounts. Spread structures follow Classic account specifications starting from 1.6 pips. Order execution occurs through institutional liquidity providers. Position sizes scale according to equity levels. Market access spans all available instruments. Negative balance protection prevents account overdraw.

Trading Instrument Access:

| Market Type | Instruments | Spreads From |

| Forex | 62 pairs | 1.6 pips |

| Indices | 15 markets | 1.0 point |

| Commodities | 5 metals | 0.3 points |

| Crypto | 8 pairs | 50 points |

Profit Withdrawal Structure

Trading profits become eligible for withdrawal under specific conditions. Requirements include standard account registration with minimum $100 deposit. Verification documentation requires approval before processing. Maximum withdrawal limits apply to bonus-generated profits. Processing occurs through verified payment methods. Support assists with withdrawal procedures.

Withdrawal Requirements

Standard conditions include:

- Account verification

- Minimum deposit completion

- Profit calculation verification

- Payment method validation

- Processing time compliance

Program Duration Management

Welcome Account access continues for 60 days from activation date. Trading capabilities terminate automatically at period conclusion. Profit claiming windows extend 14 days beyond trading period. Account conversion options require completion before expiration. Extension requests require support evaluation. Trading history remains accessible after expiration.

Account Management Interface

Welcome Account holders access management tools through secure Client Area portals. Balance monitoring displays real-time equity levels. Trading history provides detailed transaction records. Performance analytics track profit/loss metrics. Report generation enables trading analysis. Support channels offer program-specific assistance.

Management Features:

| Tool | Function | Availability |

| Balance Monitor | Real-time | 24/7 |

| Trading History | Complete | Full term |

| Analytics | Detailed | Platform based |

Trading Strategy Parameters

Specific parameters apply to Welcome Account trading activities. Position sizing aligns with account equity levels. Hedging capabilities maintain standard platform rules. Scalping strategies require minimum time intervals. News trading follows regular market conditions. Weekend holding positions observe standard rules.

Strategy Limitations

Trading restrictions include:

- Maximum position sizes

- Minimum holding periods

- Hedging parameters

- Scalping intervals

- Weekend trading rules

Support Service Structure

Dedicated support channels assist South African Welcome Account holders. Technical support addresses platform-related inquiries. Account management support helps with program questions. Document verification assistance expedites registration. Trading support provides market-related guidance. Communication channels operate during market hours.

Program Termination Conditions

Welcome Accounts terminate under specific circumstances beyond duration expiration. Violation of trading terms triggers immediate closure. Multiple account detection results in termination. Suspicious trading patterns prompt investigation. Geographic restriction violations end participation. Appeal processes require support evaluation.

FAQ:

No, program terms limit participation to one account per household.

All positions automatically close at market prices at the 60-day period end.

Profits transfer to standard accounts after meeting minimum deposit requirements.