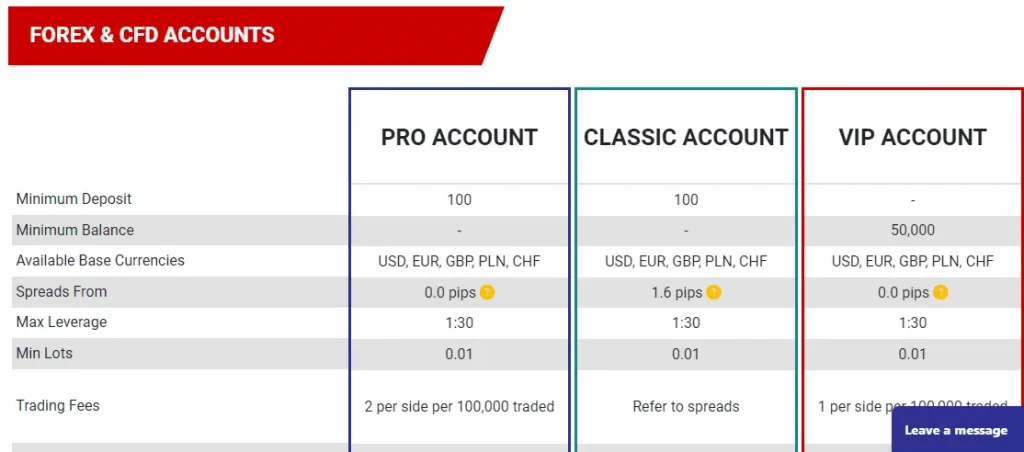

Initial Deposit Structure

Tickmill maintains accessible entry requirements through standardized minimum deposits across account types. The base requirement stands at $100 for both Classic and Raw accounts. Traders can fund accounts in multiple base currencies including USD, EUR, GBP, PLN, and CHF. The deposit threshold applies uniformly regardless of chosen trading instruments or platform selection. Currency conversion occurs automatically when funding in non-account currencies.

Account Opening Requirements:

| Account Type | Minimum Deposit | Base Currencies | Platform Access |

| Classic | $100 | USD,EUR,GBP,PLN,CHF | MT4/MT5 |

| Raw | $100 | USD,EUR,GBP,PLN,CHF | MT4/MT5 |

Deposit Methods and Processing

Multiple payment channels facilitate account funding through secure processors. Bank transfers process without additional fees from Tickmill’s side. Card payments through Visa and Mastercard complete instantly with automatic currency conversion. Electronic payment systems include Skrill, Neteller, PayPal, and regional processors. Documentation requirements vary by payment method and transaction amount.

Payment Processing Times

Standard processing windows:

- Bank wire: 1-3 business days

- Cards: Instant processing

- E-wallets: Same-day credit

- Local transfers: 1-2 business days

Currency Conversion Rates

Currency conversions apply market-based rates when funding in non-account currencies. The conversion occurs automatically during deposit processing without manual intervention requirements. Exchange rates update continuously through institutional liquidity providers. Conversion fees remain transparent with rates displayed before confirmation. The system supports major global currencies and selected regional denominations.

Supported Deposit Currencies

Primary funding currencies include:

- US Dollar (USD)

- Euro (EUR)

- British Pound (GBP)

- Polish Złoty (PLN)

- Swiss Franc (CHF)

Account Funding Process

The deposit procedure follows standardized steps through the secure client portal. Users select their preferred payment method from available options. The system generates relevant payment details including recipient information and reference codes. Transaction monitoring provides real-time status updates. Automatic notifications confirm successful deposits. Account crediting occurs based on payment method processing times.

Payment Method Specifications:

| Method | Processing Time | Minimum Amount | Maximum Amount |

| Bank Wire | 1-3 days | $100 | Unlimited |

| Cards | Instant | $100 | $10,000 |

| E-wallets | Instant | $100 | $50,000 |

Deposit Verification Requirements

Initial deposits undergo standard verification procedures aligned with regulatory requirements. Document verification includes proof of identity and residence. Additional verification applies for deposits exceeding regulatory thresholds. Source of funds documentation may apply for larger transactions. The verification process typically completes within 24 hours of submission.

Required Documentation

Verification documents include:

- Government-issued ID

- Recent utility bill

- Bank statement

- Deposit confirmation

Trading Capital Requirements

Position sizing calculations determine actual capital requirements beyond minimum deposits. Standard lot trading (100,000 units) requires sufficient margin based on leverage ratios. Retail client leverage caps at 1:30 while professional clients access up to 1:500. Margin requirements vary by instrument category and market conditions.

Deposit Bonus Programs

The Welcome Account program provides $30 in trading capital without initial deposit requirements. Volume-based rebates offer additional earning potential starting from 0.25 USD per lot. The NFP Machine contest enables earning up to $500 through accurate market predictions. Bonus programs maintain separate terms and geographical restrictions.

Trading Volume Benefits:

| Monthly Lots | Rebate per Lot | Maximum Rebate |

| 0-1000 | $0.25 | $250 |

| 1001-3000 | $0.50 | $1,500 |

| 3001+ | $0.75 | Unlimited |

Fund Protection Measures

Client deposits remain segregated in tier-1 bank accounts separate from operational funds. The Investor Compensation Fund provides coverage up to €20,000 for eligible clients. Negative balance protection prevents accounts from declining below zero. Multi-level security systems protect electronic transactions. Regular audits verify compliance with fund protection requirements.

Withdrawal Processing

Withdrawal requests process through the same channels used for deposits. The minimum withdrawal amount stands at $25 across all methods. Processing typically completes within one business day of request submission. Withdrawals return to the original funding source where possible. Standard verification applies for first-time withdrawals.

FAQ:

No, $100 represents the minimum initial deposit requirement across all account types.

Tickmill charges no deposit fees, though payment providers may apply their own charges.

Card and e-wallet deposits credit instantly for immediate trading, while bank transfers take 1-3 business days.